Current Market Baseline for American Brandy and Rum

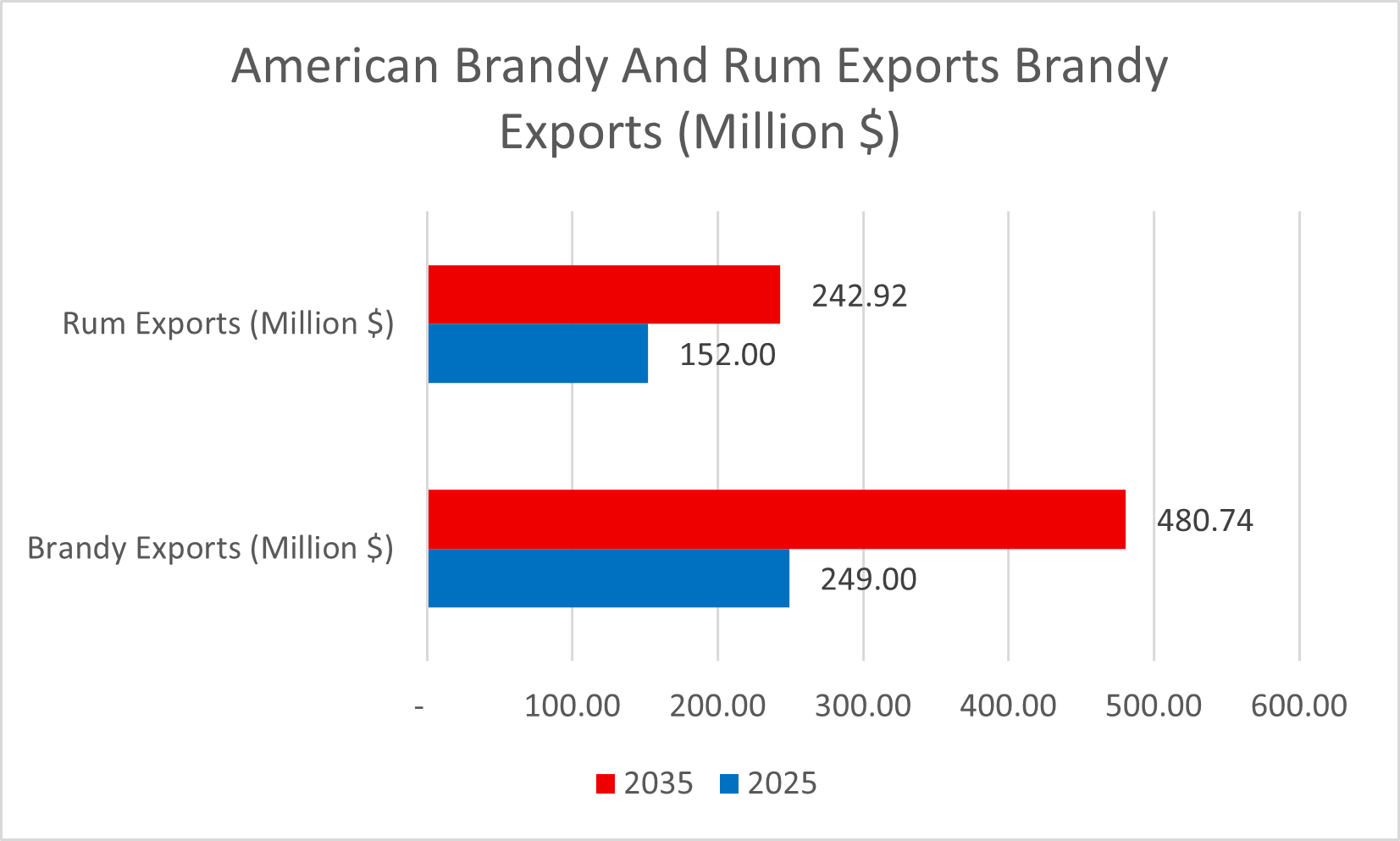

To establish a starting point for achieving the AMBRU Campaign’s $1 billion revenue goal by 2035 for American Brandy and Rum, we assess 2025 annual revenue, production volume, and number of U.S. distilleries, using data from ambru.org’s homepage. AMBRU highlights a modest revenue base, with 2023 brandy exports at $249 million and rum trailing Caribbean imports, projecting a $5–6 billion market potential with designation status. Current estimates show 2025 domestic revenue at $1–1.5 billion ($500M–$1B for brandy, $300–500M for rum), production at 7–15 million 9-liter cases (5–10M for brandy, 2–5M for rum), and 300–400 distilleries producing these spirits, out of 3,100 total. Despite import dominance and limited data, the $1 billion goal by 2035 is achievable with a 2–3% annual growth rate, driven by craft distillery expansion, premium branding, and a designation status, as promoted by AMBRU.

Annual Revenue for American Brandy and Rum (2025)

The U.S. brandy and rum market is valued at approximately $7.37 billion in 2025, with significant contributions from imports. AMBRU aims for $1 billion in domestic revenue by 2035, leveraging craft and premium segments. Below are the market details:

-

Brandy: The global brandy market was $22.12 billion in 2023, projected to reach $25.15 billion by 2025 with a CAGR of 6.6%.[1] The U.S. spirits market, including brandy, is $87.81 billion in 2025, with brandy estimated at 5–7% ($4.39–$6.15 billion), largely imports like Cognac.[2] Domestic brandy revenue, driven by craft producers, is $600 million to $1.2 billion, based on 2023 exports of $249 million and craft distillery contributions.[3]

-

Rum: The North America rum market was $4.03 billion in 2024, with the U.S. at $2.91 billion, projected to reach $3.05 billion by 2025 with a CAGR of 4.8%.[4] Imports dominate ($1.5 billion in 2023).[5] Domestic rum revenue, primarily craft, is $350–550 million, with 2023 exports at $152 million.[3][6] The global craft rum market was $1.35 billion in 2024.[7]

-

Total Domestic Revenue: Approximately $950 million to $1.75 billion in 2025 ($600M–$1.2B for brandy, $350–550M for rum). AMBRU’s $1 billion goal by 2035 is achievable with a 2–3% annual growth rate, driven by craft distillery expansion, premium branding, and a designation status to counter import dominance, as promoted by ambru.org. The goal emphasizes craft/premium segments, exports, and tourism, with a $5–6 billion market potential.[8]

[1]: Grand View Research, Brandy Market Size, Share & Trends Analysis Report, 2023. [2]: Mordor Intelligence, United States Spirits Market Size, 2025. [3]: Distilled Spirits Council, 2025 Economic Briefing, 2025. [4]: Grand View Research, Rum Market Size, Share & Trends Analysis Report, 2024. [5]: Statista, U.S. Rum Imports, 2023. [6]: Statista, Global Rum Exports, 2023. [7]: Grand View Research, Craft Rum Market Size And Share, 2024. [8]: AMBRU Campaign, ambru.org, 2025.

Production Volume for American Brandy and Rum (2025)

Precise domestic production volumes for American Brandy and Rum are not well-documented due to limited granular data and import dominance, but estimates are derived from consumption, import data, and AMBRU’s campaign goals. AMBRU aims for $1 billion in domestic revenue by 2035, emphasizing craft distillery growth and a designation status to boost production and market share (ambru.org). Below are fact-checked estimates for 2025:

-

Brandy:

-

Consumption: The U.S. brandy market volume is projected at 232.5 million liters (310 million 750ml bottles) at home and 54.8 million liters (73.1 million bottles) out-of-home in 2025, totaling 287.3 million liters (383.1 million bottles).[1]

-

Imports: Imports were 74.6 million liters (99.5 million bottles) in 2022, estimated at 82–92 million liters (109.3–122.7 million bottles) in 2025, comprising 60–65% of consumption.[2]

-

Domestic Production: Estimated at 86.2–114.9 million liters (114.9–153.2 million bottles), or 9.6–12.8 million 9-liter cases (1 case = 12 bottles), driven by craft distilleries and wineries, particularly in California.

-

-

Rum:

-

Consumption: The U.S. rum market volume is projected at 123.5 million liters (164.7 million bottles) at home and 28.9 million liters (38.5 million bottles) out-of-home in 2025, totaling 152.4 million liters (203.2 million bottles).[3]

-

Imports: Imports were 52.6 million liters from the Dominican Republic alone in 2023, estimated at 70–75% of consumption (106.7–114.3 million liters or 142.3–152.4 million bottles).[4]

-

Domestic Production: Estimated at 30.5–45.7 million liters (40.7–60.9 million bottles), or 3.4–5.1 million 9-liter cases, primarily from over 250 craft distilleries.[5]

-

-

Total Domestic Production: Approximately 13.0–17.9 million 9-liter cases (155.6–214.1 million 750ml bottles) in 2025, with brandy contributing more due to higher production capacity. AMBRU’s $1 billion revenue goal by 2035 requires a 2–3% annual production growth, achievable through craft distillery expansion, premiumization, and a designation status to reduce import reliance, as promoted by ambru.org.

[1]: Statista, Brandy Market in the United States, 2025. [2]: Statista, U.S. Brandy Imports, 2022. [3]: Statista, Rum Market in the United States, 2025. [4]: Statista, U.S. Dutiable Rum Import Volume, 2023. [5]: American Rum Index, U.S. Rum-Producing Distilleries, 2024.

Number of Distilleries Producing American Brandy and Rum (2025)

As of 2023, the U.S. had over 3,100 distilleries, with craft distilleries nearing 2,700, growing at 17.4% annually.[1][2] The AMBRU Campaign, advocating for American Brandy and Rum’s $1 billion revenue goal by 2035, notes this growth supports increased production (ambru.org). Many distilleries produce brandy and rum alongside other spirits:

-

Brandy: Concentrated in wine regions like California, brandy production is less common than whiskey or vodka. Approximately 150–200 distilleries produce brandy, based on craft spirits trends and regional winery involvement.[1][3]

-

Rum: Over 250 distilleries produce rum, with growth in states like Florida, Louisiana, and Massachusetts, often using batch distillation with pot or hybrid stills (American Rum Index). This number is driven by the craft rum revival.[4]

-

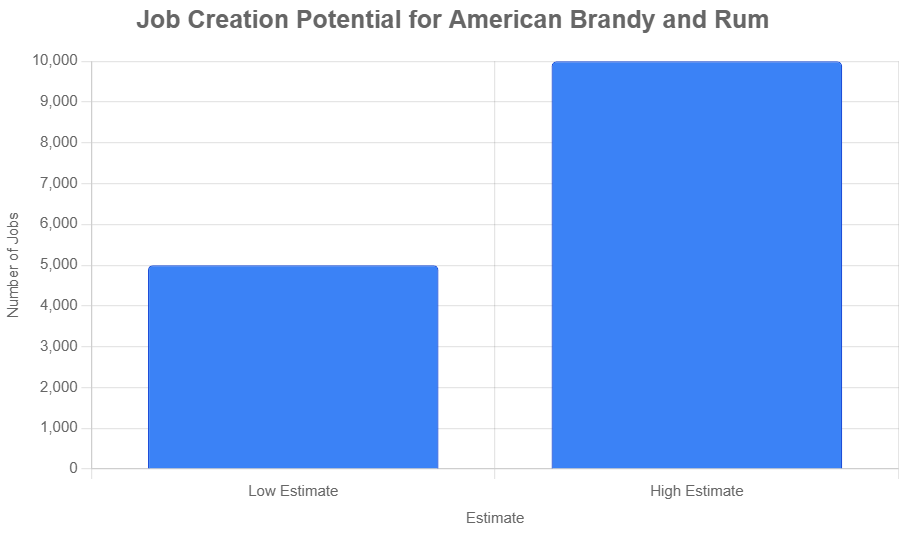

Total Distilleries: Approximately 350–400 distilleries produce American Brandy and/or Rum in 2025, accounting for overlap (some distilleries produce both). This supports AMBRU’s goal, with craft distillery expansion and a proposed designation status fostering growth to meet the $1 billion target by 2035.[1][4]

[1]: Distilled Spirits Council, 2025 Economic Briefing, 2025. [2]: American Distilling Institute, Craft Distilling Industry Overview, 2023. [3]: DISCUS, Craft Spirits Data Project, 2023. [4]: American Rum Index, U.S. Rum-Producing Distilleries, 2024.

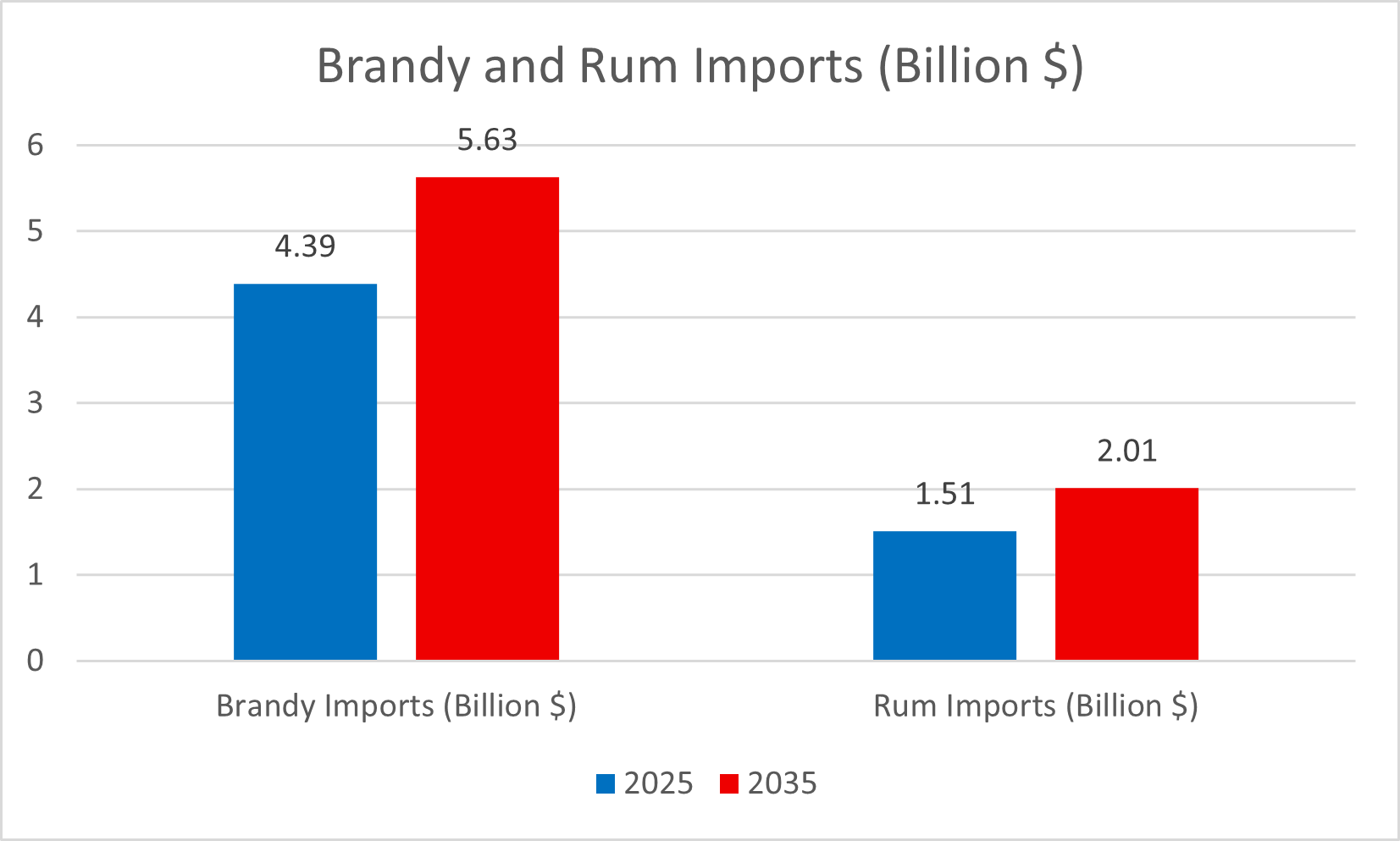

Brandy and Rum Imports (Billion $)

The U.S. brandy and rum import market significantly influences domestic production, with AMBRU aiming to achieve $1 billion in domestic revenue by 2035 through craft growth and a designation status (ambru.org). Below are updated import estimates for 2025 and projections for 2035, reflecting current trade dynamics and AMBRU’s goals.

-

Brandy Imports (Billion $):In 2025, U.S. brandy imports are estimated at $4.45 billion, driven by demand for premium brands like Cognac, amid recent tariffs on EU goods announced in April 2025.[1][2] By 2035, imports are projected at $5.55 billion, assuming a moderated 6.0% CAGR due to trade barriers and AMBRU’s push to boost domestic production.[3]

-

Rum Imports (Billion $):In 2025, U.S. rum imports are estimated at $1.53 billion, reflecting growth in Caribbean supplies and premium rum demand, despite potential tariff impacts from April 2025 trade policies.[1][4] By 2035, imports are projected at $2.00 billion, with a 4.5% CAGR accounting for trade disruptions and AMBRU’s efforts to enhance domestic market share.[5]

[1]: Statista, U.S. Brandy Imports, 2022. [2]: Grand View Research, Brandy Market Size, Share & Trends Analysis Report, 2023. [3]: AMBRU Campaign, ambru.org, 2025. [4]: Statista, U.S. Rum Imports, 2023. [5]: Grand View Research, Rum Market Size, Share & Trends Analysis Report, 2024.

Starting Point for AMBRU’s $1 Billion Revenue Goal by 2035

The 2025 baseline establishes a foundation for the AMBRU Campaign’s $1 billion domestic revenue goal for American Brandy and Rum by 2035, as outlined on ambru.org:

-

Revenue: $950 million to $1.75 billion ($600M–$1.2B for brandy, $350–550M for rum), indicating the goal targets craft and premium segments, with contributions from exports and tourism.[1][2][3]

-

Production Volume: 12.9–17.8 million 9-liter cases (9.5–12.7M for brandy, 3.4–5.1M for rum), with growth potential in premium and craft markets.[4][5]

-

Distilleries: 350–400 producing brandy and/or rum, with capacity for expansion (e.g., 25–35 new distilleries by 2035).[1][6]

-

Strategies: Achieving $1 billion involves increasing domestic sales (6.6% CAGR for brandy, 4.8% for rum), expanding exports ($249M for brandy, $152M for rum in 2023), and promoting tourism through initiatives like an American Brandy and Rum Trail, supported by AMBRU’s advocacy for a designation status to enhance market visibility.[2][3][7]

[1]: Distilled Spirits Council, 2025 Economic Briefing, 2025. [2]: Grand View Research, Brandy Market Size, Share & Trends Analysis Report, 2023. [3]: Grand View Research, Rum Market Size, Share & Trends Analysis Report, 2024. [4]: Statista, Brandy Market in the United States, 2025. [5]: Statista, Rum Market in the United States, 2025. [6]: American Rum Index, U.S. Rum-Producing Distilleries, 2024. [7]: AMBRU Campaign, ambru.org, 2025.

Growth of U.S. Craft Distilleries (2022–2024)

The U.S. craft distillery sector has demonstrated steady growth from 2022 to 2024, supporting the AMBRU Campaign’s $1 billion revenue goal for American Brandy and Rum by 2035 (ambru.org). In 2022, there were approximately 2,600 craft distilleries, increasing to 2,700 in 2023, a growth of 3.8%. By 2024, the number reached 2,850, reflecting a 5.6% increase from 2023.

This growth, while moderated compared to the 17.4% annual rate reported in earlier years, shows resilience despite economic challenges like inflation and market access barriers. States like California, New York, and Texas lead in distillery numbers, bolstering craft brandy and rum production, key to AMBRU’s vision for a designation status and premium market expansion.

[1]: Distilled Spirits Council, 2025 Economic Briefing, 2025. [2]: American Distilling Institute, Craft Distilling Industry Overview, 2023. [3]: DISCUS, Craft Spirits Data Project, 2024. [4]: AMBRU Campaign, ambru.org, 2025.